Taxation Course and

GST IN MUMBAI

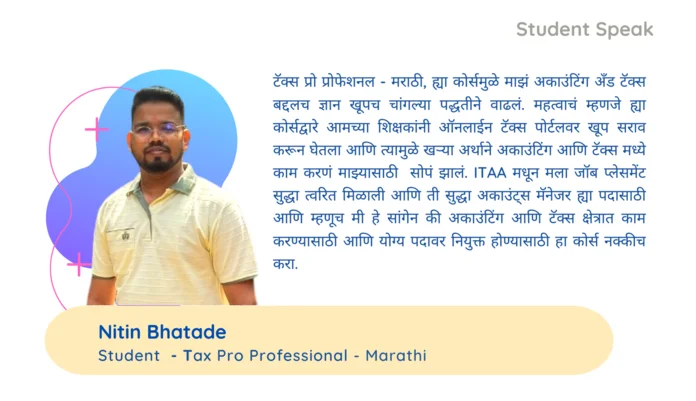

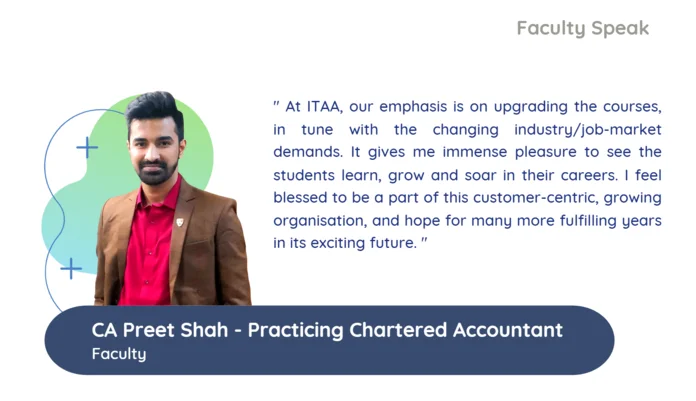

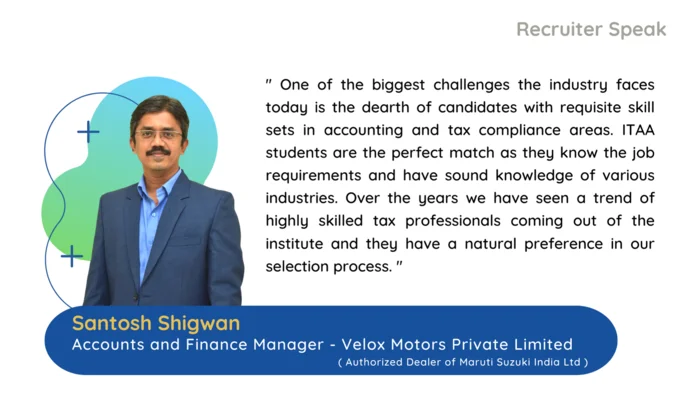

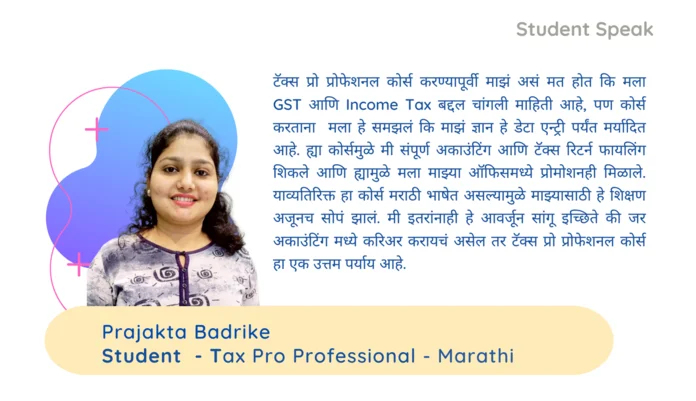

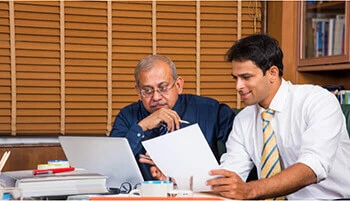

The institute prioritizes students’ career advancement, offering job placement support at esteemed firms. ITAA boasts a robust learning management system that grants easy access to course materials. Classes are interactive and multilingual, accommodating Marathi, Hindi, English, and Hinglish speakers. This linguistic diversity ensures thorough understanding and active participation, making ITAA an inclusive choice for taxation courses in Mumbai. Committed to producing adaptable professionals, ITAA’s Professional Skilling Programs in Accounting & Taxation in Thane shine as a beacon of educational excellence. They fulfill dreams of industry readiness, navigating the dynamic financial landscape, and transforming aspirations into reality. Enhance your expertise with professional online taxation courses in Mumbai. Dive deep into tax regulations, strategies, and compliance from the comfort of your home. Stay updated with the latest industry trends and advance your career with a comprehensive curriculum tailored to meet the demands of the dynamic taxation landscape.